Toll‑free numbers often raise questions. If you’ve received calls from this 866-295-8602 number, you may be wondering about its purpose and the best way to handle these contacts. This article provides clear, up‑to‑date information on the debt collection calls you may be receiving, explains who is behind them, and offers practical advice to protect yourself.

| Company Name | Founded | Industry | Headquarters |

|---|---|---|---|

| Portfolio Recovery Associates | 1996 | Debt Collection | Norfolk, VA, USA |

| Website | — | — | Click Here |

A second table below summarizes consumer reviews and user feedback on calls from this toll‑free number.

| Aspect | Feedback Summary |

|---|---|

| Call Type | Mix of automated (robocalls) and live agent calls |

| Common Complaints | Harsh messaging, aggressive tactics, unclear caller identification |

| Consumer Advice | Request written validation, document calls, use call blocking apps |

| Reported Outcome | Many consumers report successful dispute resolution with proper action |

Overview of 866-295-8602 Debt Collection

Portfolio Recovery Associates primarily initiated debit collection calls using this toll‑free number. They purchase unpaid debts from original creditors—such as banks and credit card companies—and contact consumers to collect outstanding balances.

Key facts include:

-

Business Model: The company buys debts at a fraction of their face value and works to collect the full amount from consumers.

-

Method of Contact: Calls may be automated or conducted by live agents, sometimes using caller ID spoofing to appear more legitimate.

-

Consumer Impact: Such calls can cause anxiety and affect credit reports if not properly addressed.

Who Is Behind the Calls? 866-295-8602

Portfolio Recovery Associates in Detail

Portfolio Recovery Associates, a major player in debt collection, has been operating since 1996. They use aggressive tactics and automated systems to contact consumers regarding debts that have been transferred from original creditors. Here are some important points about their operations:

-

Debt Purchase and Collection: When creditors can no longer collect payments, they sell the debt to companies like Portfolio Recovery Associates.

-

Communication Style: Consumers may receive robocalls followed by live calls from representatives who request debt validation.

-

Legal Framework: The company must adhere to the Fair Debt Collection Practices Act (FDCPA), which requires them to provide clear documentation of the debt upon request.

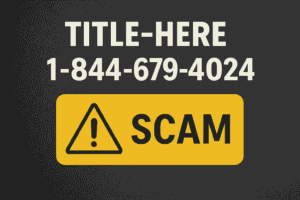

Recognizing Legitimate Versus Scam Calls

Knowing whether a call is legitimate is critical. Here’s a list of warning signs and red flags to help you decide:

-

Legitimate Debt Collection Calls:

-

Caller identifies themselves clearly.

-

Provides written validation upon request.

-

Follows FDCPA guidelines.

-

-

Potential Scam Characteristics:

-

Aggressive, threatening language.

-

Caller refuses to provide detailed information.

-

Calls outside of permitted hours.

-

Lack of follow‑up documentation (letters or emails).

-

Consumer Experiences and Case Studies

Real-World Case Study

One consumer, Jane, received multiple calls from a debt collection number. Initially, she was unsure if the calls were related to a valid debt. After requesting a written validation, she discovered that the debt was sold several years ago. With this information in hand, Jane successfully disputed the debt and improved her credit report. This case demonstrates the importance of:

-

Documentation: Always ask for written verification.

-

Consumer Rights: Knowing your rights under the FDCPA can help you negotiate or dispute a debt.

-

Action: Using call‑blocking apps and maintaining a record of all communications can provide protection.

Consumer Feedback Summary

Many users report similar experiences when dealing with these calls. Key feedback includes:

-

Persistent Calls: Frequent and repetitive calls are common.

-

Harassment Claims: Some consumers have described the calls as aggressive or harassing.

-

Resolution Methods: Successful dispute resolution often comes from insisting on debt validation and seeking legal advice if necessary.

Steps to Handle Debt Collection Calls

A smartphone screen displaying an incoming call from 866-295-8602, emphasizing telecommunication and debt collection awareness.

Practical Action List

To protect yourself and manage calls effectively, consider the following steps:

-

Request Debt Validation:

-

Ask for written documentation.

-

Verify details with the original creditor if necessary.

-

-

Document Everything:

-

Keep a log of call dates, times, and the caller’s name.

-

Save any voicemails or text messages.

-

-

Use Call Blocking Tools:

-

Apps like Nomorobo or Robokiller can help block unwanted calls.

-

-

Consult Legal Advice:

-

If you suspect harassment or fraudulent activity, consider contacting a consumer protection attorney.

-

-

Register with Do Not Call Lists:

-

Use official resources like the National Do Not Call Registry to reduce spam calls.

-

Useful Table: Recommended Call Blocking Apps

| App Name | Key Features | Platforms |

|---|---|---|

| Nomorobo | Blocks robocalls and spam, easy setup | iOS, Android |

| Robokiller | Uses AI to block unwanted calls, customizable | iOS, Android |

| Truecaller | Caller identification, spam blocking | iOS, Android |

Legal Rights and Consumer Protections

Understanding the FDCPA

The Fair Debt Collection Practices Act (FDCPA) protects consumers by outlining what debt collectors can—and cannot—do. Key points include:

-

Debt Validation: You have the right to request a written validation notice.

-

Prohibited Practices: Debt collectors are not allowed to use deceptive or abusive language.

-

Dispute Rights: You can dispute a debt in writing within 30 days of initial contact.

-

Legal Recourse: If a debt collector violates these guidelines, you may report them to the FTC or file a complaint with your state attorney general.

Consumer Protection List

-

Know Your Rights: Familiarize yourself with FDCPA guidelines.

-

Request Written Verification: Always ask for documentation.

-

Report Harassment: File a complaint if a collector fails to comply with legal standards.

-

Seek Professional Advice: Contact legal or credit repair professionals when in doubt.

Tools and Resources for Call Protection

Essential Resources

To stay protected, consider these helpful tools and websites:

-

Do Not Call Registry: Register Here

-

FTC Complaint Assistant: File a Complaint

-

Consumer Financial Protection Bureau: CFPB

Recommended Call Blocking Tools

In addition to the apps mentioned earlier, here’s a quick reminder:

-

Nomorobo: Highly rated for blocking robocalls.

-

Robokiller: Uses advanced algorithms to prevent spam calls.

-

Truecaller: Provides detailed caller identification and community ratings.

Conclusion

Understanding who is behind these debt collection calls and knowing your rights is essential. Whether you choose to validate the debt or block the calls entirely, protecting yourself starts with staying informed and taking proactive steps.

Remember, if you receive a call from 866-295-8602, review the details carefully and use the resources provided here to manage and dispute the debt if necessary.

By following the steps outlined above, you can safeguard your financial future and maintain control over your communications.