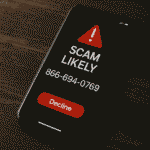

The phone number 866-576-4748 appears in many reports about suspicious debt collection calls. In this article, you’ll discover real facts about toll-free scam calls, learn to recognize red flags, and get practical tips to protect yourself.

866-576-4748 Introduction

Consumers have been increasingly targeted by scam calls that mimic legitimate debt collectors. Many have reported urgent messages, vague details, and even personal information usage. This article dives into the reality behind these calls, providing clear, up-to-date facts, lists, tables, and case studies to empower you to recognize scams and take action.

Below is an additional table that outlines some key facts about toll-free scam calls:

| Fact | Detail |

|---|---|

| Toll-Free Number Usage | Often used by legitimate companies but also abused by scammers |

| Common Scam Tactics | Urgency, vague details, threats of legal action |

| Consumer Impact | Can lead to financial loss, stress, and potential identity theft |

| Reporting Resources | Consumer Financial Protection Bureau (CFPB), local law enforcement, BBB |

Understanding Toll-Free Numbers in Debt Collection

Toll-free numbers 866-576-4748 are designed for convenience and are used by businesses to offer free calls to their customers. Unfortunately, scammers exploit these numbers to mask their true identity and location.

Why Scammers Love Toll-Free Numbers:

- They lend an appearance of legitimacy.

- They allow scammers to remain anonymous while reaching a broad audience.

- They create a false sense of urgency with automated texts and threatening language.

Legitimate vs. Scam Call Characteristics

Below is a comparison table that outlines the differences between genuine debt collection calls 866-576-4748 and scam calls:

| Characteristic | Legitimate Debt Collector | Scam Call |

|---|---|---|

| Information Provided | Detailed account information, written notice provided | Vague details, lack of official documentation |

| Communication Style | Professional, clear, and courteous | Aggressive, urgent, and threatening |

| Verification Process | Requests written validation of debt before payment | Demands immediate payment with little proof |

| Caller ID Details | Shows clear, verifiable business name | Often uses masked numbers or generic toll-free numbers |

| Legal Compliance | Adheres to FDCPA guidelines and provides mini-Miranda warning | Ignores legal protocols and uses scare tactics |

Legitimate calls provide verifiable evidence and encourage you to confirm details with your original creditor. In contrast, scam calls rely on fear to force an immediate response.

Analysis of the Suspicious 866-576-4748 Number

Reports from websites like 800Notes and BBB Scam Tracker reveal a pattern of complaints about this phone number. Many users have shared case studies where they received text messages claiming overdue debts without providing any reliable details from 866-576-4748 .

Real Case Study

A user received a text stating, “Your account is overdue. We need a response today or we must take further action.” The message provided a vague account reference, but when the user contacted the number, the representative offered no clear explanation and used aggressive language. Further investigation with the original creditor confirmed that there was no outstanding balance.

Key Observations:

- Vague Debt Details: Scammers rarely give precise information.

- Threatening Language: Terms like “fees and penalties pending” or “legal action” are common scare tactics.

- Multiple Reports: Numerous consumers have reported similar texts, indicating a pattern rather than an isolated incident.

This analysis demonstrates that many calls associated with this number lack legitimacy. Consumers are urged to exercise caution and verify any debt claims independently.

Identifying Scam Indicators

Recognizing the red flags of scam calls is crucial. Here are some bolded key indicators to help you spot suspicious debt collection communications:

- Urgency and Threats: Scammers pressure you with immediate deadlines and warnings of legal action.

- Lack of Verifiable Information: They often do not provide detailed account data or contact information for the original creditor.

- Requests for Personal Data: Scammers may ask for sensitive information, such as partial social security numbers, which legitimate collectors would never request over the phone.

- Inconsistent Caller Information: Some callers switch between different phone numbers or company names, a common sign of a scam operation

Verifying Legitimacy: What to Check

When you receive a call or text from a debt collector, it’s important to verify its legitimacy before taking any action. Follow these steps:

Cross-Reference Information

Compare the details provided in the message with your records. If you don’t recall the debt, contact the original creditor using a phone number or email you trust.

Know Your Rights

Under the Fair Debt Collection Practices Act (FDCPA), debt collectors are required to provide written verification of the debt. This includes details such as the original creditor’s name, the amount owed, and your rights as a consumer.

Use Trusted Resources

Visit reputable websites like the Consumer Financial Protection Bureau (CFPB) for guidelines on dealing with debt collectors. Additionally, check platforms such as the BBB Scam Tracker and 800Notes for user reports.

Verification Checklist

| Step | Action |

|---|---|

| Check for Written Notice | Request written proof of the debt and details of the claim. |

| Contact the Creditor | Use verified contact information to confirm the debt. |

| Review Legal Rights | Familiarize yourself with FDCPA guidelines. |

| Search Online Reviews | Look for similar reports on reputable platforms. |

| Consult a Professional | Consider speaking with a credit counselor or attorney. |

Following this checklist helps ensure you are not falling prey to fraudulent schemes like 866-576-4748 .

Steps to Take If Contacted by a Suspicious Call

If you suspect that a debt collection call is a scam, take these practical steps immediately:

Do Not Provide Personal Information

Never reveal sensitive data such as your full name, address, or financial details over the phone or via text without verifying the caller’s identity.

Hang Up and Verify

Politely end the call and independently verify the debt by contacting your original creditor. Do not use the number provided by the caller.

Document the Interaction

Keep a record of the call details, including the time, date, and any information provided. This documentation can be crucial if you decide to report the scam.

Report the Scam

File a complaint with the Consumer Financial Protection Bureau (CFPB) and your local law enforcement agency. Reporting helps authorities track scam patterns and prevent further fraud.

Tools to Block and Report Scam Calls

Modern technology offers several tools to help you block unwanted scam calls and report them effectively.

Popular Call-Blocking Tools

- Nomorobo:

An effective service that blocks robocalls and scam calls by identifying known scam numbers. - Hiya:

An app that not only blocks spam calls but also provides detailed caller information. - RoboKiller:

Uses advanced algorithms to filter out scam calls before they reach you.

Case Studies: Real-Life Experiences

Real-world examples illustrate the tactics scammers use and the steps consumers can take to protect themselves.

Case Study 1: The Mysterious Medical Bill

Scenario

A consumer received a text stating, “Your account is overdue. Call our office immediately to settle your medical bill.”

Outcome

After calling, the representative provided vague details and used threatening language. The consumer then contacted the hospital and learned that no such bill existed. The incident was later reported to the CFPB, and the consumer received guidance on how to block future calls.

Key Takeaways

- Always verify debt claims with the original creditor.

- Do not engage with callers who use threatening language.

- Document all interactions for potential legal action.

Case Study 2: The Fake Process Server

Scenario:

A different consumer received a call from someone claiming to be a process server, stating that failure to act immediately would result in legal action.

Outcome

The caller refused to provide written details. The consumer verified with local courts and discovered that no case had been filed. The incident led to a successful complaint filed with state authorities, and the scam operation was exposed online.

Key Takeaways

- Process servers never call ahead for settlements.

- Always insist on written communication.

- Use trusted sources to verify legal claims.

FAQs

What should I do if I receive an urgent text about an overdue bill?

Verify the details with your original creditor using trusted contact information. Do not rely solely on the information provided in the text.

How can I identify a scam call?

Look for urgent language, lack of written verification, and requests for personal information. Compare these signs with the guidelines provided by FDCPA.

Are there tools available to block scam calls?

Yes, apps like Nomorobo, Hiya, and RoboKiller can help reduce unwanted calls and protect your privacy.

What legal protections do I have?

Under the FDCPA, debt collectors must provide written verification of any debt and adhere to strict guidelines in their communication. If a scam call violates these rules, report it to the CFPB.

Where can I report scam calls?

You can file complaints with the Consumer Financial Protection Bureau (CFPB), the Better Business Bureau (BBB), and local law enforcement agencies.

Conclusion

Consumers need to be vigilant against scam calls from 866-576-4748 that mimic legitimate debt collection practices. By understanding how toll-free numbers are abused, recognizing scam indicators, and taking immediate action, you can protect yourself and your personal information.

Key points to remember:

- Verify any debt claims with your original creditor.

- Use call-blocking tools and report suspicious calls to the CFPB.

- Keep records of all interactions for future reference.

Empower yourself with knowledge and act promptly to stop scammers from taking advantage of your trust. Remember, staying informed is your best defense against fraudulent debt collection practices.

Also Read: 866-850-3077 | Learn All About It